Empower Your Financial Future With Expert Credit Rating Coaching: Transformative Solutions and Insights

By delving right into the ins and outs of credit score scores, financial debt management methods, and the construction of a durable economic foundation, credit rating counseling supplies transformative solutions and very useful insights that can shape the trajectory of one's monetary future. Via the experience and support of seasoned experts, individuals can unlock a riches of understanding that leads the means for informed decision-making and long-lasting monetary success.

Relevance of Credit Scores Therapy

In today's complicated economic landscape, the relevance of credit rating therapy can not be overemphasized. Credit score counseling plays an essential function in aiding people browse the ins and outs of personal finance, especially in managing debt and boosting credit rating. By looking for assistance from certified credit rating counselors, people can gain beneficial insights into budgeting, financial debt payment approaches, and credit scores monitoring techniques.

Among the essential advantages of credit scores therapy is the chance for people to develop individualized plans customized to their unique financial situations. These strategies usually consist of actionable actions to lower financial obligation, negotiate with creditors, and develop healthy and balanced financial routines for the long-term. Additionally, credit history therapy solutions offer an encouraging setting for people to address their financial difficulties openly and constructively.

In addition, credit report therapy can help individuals stay clear of personal bankruptcy and create abilities to keep economic stability. Through education on topics such as financial literacy and finance, people can make informed decisions about their finances and work in the direction of accomplishing their lasting financial objectives. Eventually, credit rating therapy works as a beneficial resource for individuals looking to take control of their monetary well-being and build a strong foundation for a safe financial future.

Comprehending Credit History

Credit report are mathematical depictions that reflect an individual's creditworthiness based upon their credit rating and monetary habits. These scores usually vary from 300 to 850, with greater ratings suggesting lower debt danger. Recognizing credit report is essential as they play a considerable duty in figuring out a person's capability to accessibility credit report, the rate of interest they might receive, and even their possibilities of approval for rental applications or task opportunities.

A number of factors add to the estimation of a credit rating, including repayment history, credit score utilization, size of credit rating, sorts of credit scores utilized, and brand-new credit rating queries. Payment background holds one of the most substantial weight in figuring out a credit history score, highlighting the significance of making prompt settlements on financial debts. Maintaining low charge card equilibriums and preventing opening up multiple new accounts within a brief period can likewise favorably impact credit ratings.

Reliable Financial Obligation Management Approaches

Understanding credit report lays the structure for applying reliable financial debt administration approaches, which are vital for people aiming to improve their monetary health and stability. The following action is to create a comprehensive financial debt management plan as soon as you have a clear picture of your debt standing. Begin by creating a budget plan that describes your revenue, expenditures, and financial debt responsibilities. This will certainly help you identify areas where you can cut down on investing to designate even more funds in the direction of financial obligation repayment.

Prioritize your financial obligations by focusing on high-interest accounts initially while making minimum repayments on others to avoid penalties. Take into consideration financial obligation consolidation to streamline numerous settlements right into one, possibly at a reduced rate of interest - credit counselling in singapore. Working out with financial institutions for far better terms or seeking help from a credit report therapy firm can additionally be beneficial

Remember to constantly monitor your progress and make modifications to Discover More your debt administration strategy as needed. By proactively addressing your financial obligations and adhering to an organized settlement method, you can work in the direction of economic liberty and a healthier financial future.

Structure a Solid Financial Structure

Developing sound monetary routines is important for developing a strong foundation for your economic well-being. Building a strong monetary foundation involves a critical and intentional approach to managing your cash. One crucial aspect is creating a budget plan that lines up with your economic goals and income. By tracking your expenses and revenue, you can identify areas where adjustments are needed to ensure you are living within your methods and conserving for the future.

An additional key element of a strong economic structure is developing an emergency situation fund. This fund serves as an economic safeguard, providing you with a buffer in instance of unexpected costs or emergencies. Professionals typically recommend saving three to six months' well worth of living expenses in your reserve to weather monetary storms without hindering your lasting objectives.

Encouraging Your Financial Future

To strengthen the foundation laid in building a strong economic foundation, the course to economic empowerment involves taking advantage of crucial strategies for safeguarding a durable and flourishing future. One vital facet of equipping your economic future is setting achievable and clear monetary goals. By specifying certain purposes, whether it be saving for retired life, purchasing a home, or beginning a business, individuals can develop a roadmap towards monetary success. Additionally, cultivating a behavior of routine budgeting and monitoring costs is important in understanding where money is being assigned and identifying locations for prospective savings or investment.

Additionally, education and learning plays a vital duty in monetary empowerment. Continually seeking understanding regarding individual financing, investment chances, and economic patterns can gear up individuals with the devices needed to make educated choices. Engaging with expert credit report therapists can additionally give valuable insights and advice on managing financial debt, boosting credit report, and creating sustainable financial techniques. By proactively taking control of one's monetary scenario and carrying out strategic measures, individuals can lead the way in the direction of a flourishing and secure monetary future.

Conclusion

By diving into the intricacies of credit report ratings, debt administration approaches, and the construction of a robust monetary foundation, credit scores therapy offers transformative services and very useful insights that can shape the trajectory of one's financial future. With education on subjects such as financial literacy and money administration, people can make enlightened choices about their finances and job towards accomplishing their long-term monetary objectives. Eventually, credit history counseling serves as a useful resource for individuals looking to take control of their financial wellness and build a solid structure for a protected monetary future.

By proactively taking control of one's economic scenario and carrying out strategic steps, individuals can lead the means in the direction of a thriving and secure financial future. credit counselling in singapore.

By recognizing debt scores, applying reliable financial obligation management strategies, and additional info constructing a solid monetary structure, people can take control of their economic well-being.

Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Amanda Bearse Then & Now!

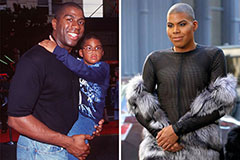

Amanda Bearse Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!